Assam Credit Guarantee Scheme | Apply Online | Application Form | The Government of Assam has implemented the Credit Guarantee Scheme to provide credit guarantee to the micro and small enterprises of the state. This scheme will help in boosting the economy of the state. How to get the benefit of Credit Guarantee Scheme and how to register for it. To get all this information, you have to read this article till the end.

ASSAM CREDIT GUARANTEE SCHEME

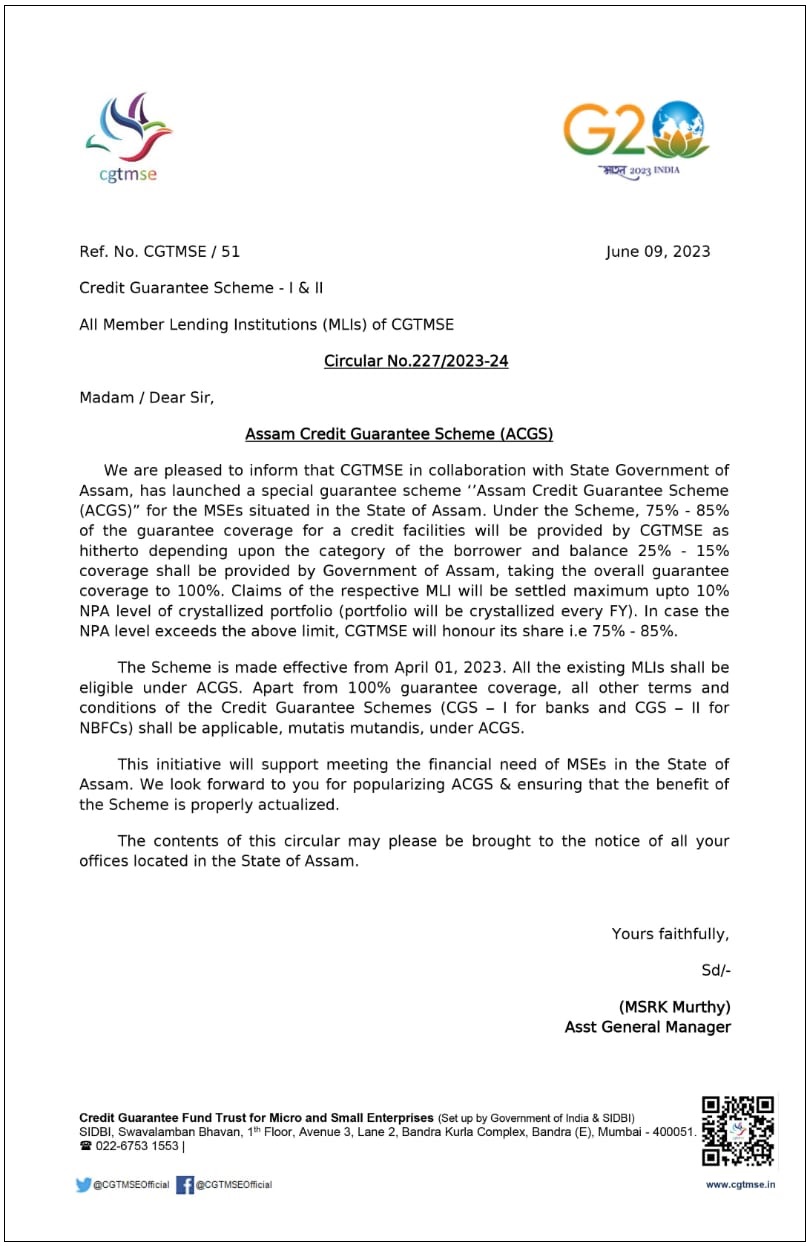

The Government of Assam has launched the Credit Guarantee Scheme. The scheme will secure financing for the medium and small companies of the state. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has been jointly set up by the Ministry of Micro, Small and Medium Enterprises (MSME), Government of India. 75% – 85% guarantee facility for loan facilities under this scheme will be provided depending upon the category of the borrower and balance amount.

Assam Government will give 25% – 15% coverage, making the total guarantee coverage 100%. In addition to the 100% guarantee coverage, all other terms and conditions of the Credit Guarantee Scheme (CGSI for banks and CGS-II for NBFCs) will mutatis mutandis be applicable to ACGS. This scheme will help in meeting the financial needs of MSES in Assam.

About Of the Assam Credit Guarantee Scheme

| Name Of the Scheme | Assam Credit Guarantee Scheme |

| By Whom Initiated done | By the Government of Assam |

| Beneficiary | Micro and Small Enterprises |

| Assistance to be Provided | Providing Credit Guarantee |

| Guaranteed Coverage | 100% |

| Share of CGTMSE | 75-85% |

| Share of State Govt | 15-25% |

| Application Process | Online / Offline |

| Official Website | Coming Soon |

Objective Of the Assam Credit Guarantee Scheme

The main objective of the scheme is to provide credit guarantee to the micro and small enterprises of the state, so that they can boost the economy of the state.

Eligibility for the Assam Credit Guarantee Scheme

- The applicant must be a resident of the state of Assam.

- All micro and small enterprises located in Assam will be eligible to claim credit guarantee through the ACGS scheme.

- Credit Guarantee Scheme – I and II rules also apply.

- State Governments inform that their share of guarantee should be 15-25% depending on the category of borrowers.

Important Documents of the Assam Credit Guarantee Scheme

- Domicile Certificate

- Identity Certificate

- Loan Documents

- Passport size photographs of the owners

- Udyam Registration Details

- Mobile Number

Benefits of the Assam Credit Guarantee Scheme

- Assam Credit Guarantee Scheme will provide benefits to the micro and small enterprises of the state of Assam.

- This scheme will be beneficial from the point of view of providing credit guarantee.

- By getting the benefit of the scheme, the borrowers will be able to apply for the loan on the guarantee of CGTMSE and Assam Government.

- This scheme will provide 100% credit guarantee coverage. Out of which 75-85% will be contributed by CGTMSE and 15-25% by the State Government of Assam.

- Claims of member lending institutions up to a maximum of 10% NPA level of the crystallized portfolio will be settled.

- Whenever the NPA level is more than 10%, CGTMSE can provide credit guarantee up to 75-85%.

- Assam Credit Guarantee Scheme (ACGS) will play an important role in meeting the financial requirement of micro and small enterprises.

- The scheme will be notified by CGTMSE and Assam State Government.

- By getting the benefit of this scheme, Micro and Small Enterprises (MSEs) will be able to invest more in their business.

- When the small business will grow at high speed and the economy of the state will get a boost.

Features of the Assam Credit Guarantee Scheme

- Securing loans to medium and small businesses in the state

- Extending the benefit of guarantee coverage or credit facilities

- To meet the financial requirement of MSEs in the state of Assam.

How to Online Registration for the Assam Credit Guarantee Scheme

Applicants who want to apply for the scheme through online mode will have to wait for a while. Because the official website has not been started yet. When the website will be launched, applicants will be able to apply online by clicking on the link provided.

ACGS Application Form Download

After the launch of the official website, the option of “Assam Credit Guarantee Scheme Application Form Download” will appear on the home page of the site. You have to download the Application Form by clicking on this option. After that you have to fill this form, then go to the concerned department and submit it.

Assam Credit Guarantee Scheme – Helpline Number

Helpline numbers will also be started soon for Assam Credit Guarantee Scheme. Through which the applicant will be able to get all the information regarding the scheme by calling.

I hope you have got all the information through this article. If you like the article then do comet and like it.