Apun Ghar Home Loan Scheme has been implemented by the Chief Minister of Assam for the betterment of the citizens of the state. Through which home loans are provided to the citizens of the state at concessional interest rates through banks, so that citizens can help in getting their house. How to get the benefit of this scheme and how to apply under it. To get all this information, you have to read this article till the end. So let’s know about Apun Ghar Home Loan Scheme.

Apun Ghar Home Loan Scheme 2024

Apun Ghar Home Loan Scheme has been started by the Government of Assam to provide housing facilities to the employees of the state. Under which home loans will be provided to the state government employees at concessional interest rates. In which subsidy on loan will be provided by the government to the people of the state to build their new house. A subsidy of up to 2.50 lakh will be provided to an applicant on a loan of 40 lakhs to build his house.

By taking advantage of this scheme, eligible beneficiaries will also be able to buy a new flat. Out of which a loan of up to 15 lakh will be given to the employees for a period of 20 years on the home loan. Applicant can apply for loan from scheduled banks of Regional Rural Banks of Assam Co-operative Apex Bank operating in Assam. Those people who have not got the benefit of this scheme last year, they will also be able to apply to take advantage of this scheme.

Overview of Apun Ghar Home Loan Yojana

| Name Of the Scheme | Apun Ghar Home Loan Scheme | |

| Started by | By the Government of Assam | |

| Beneficiary | Citizens of the State | |

| Assistance to be Provided | Providing home loan facility at concessional interest rates | |

| Application Process |

| |

| Official Website | https://finance.assam.gov.in/ |

Main aspects of the Scheme

Under the Apun Ghar Home Loan Scheme, the government will provide housing loans at a concessional rate of 5% for female employees and 5.05% for male employees. The eligible beneficiaries availing the benefits of the scheme will be provided with no loan and collateral security and processing fee.

State government employees will be able to take loans up to Rs 15 lakh with an interest subsidy of 3.5%. The loan given to the beneficiaries will be directly deposited in their bank account. Due to which their financial side will be strong. The benefit of Apun Ghar Home Loan Scheme can be obtained by applying online.

Objective of the Apun Ghar Home Loan Yojana

The main objective of the scheme is to provide the facility of home loan to the employees of the state at concessional interest rates.

Apun Ghar Home Loan – Interest Rates & Subsidy

| Description | For Men | For Women |

| loan amount | 15 Lakh | 15 Lakh |

| Interest subsidy | 3.5% | 3.5% |

| Interest rate after subsidy | 5.05% | 5% |

| Maximum loan tenure | 20 Year | 20 Year |

| Effective EMI before subsidy (for a loan of Rs 15 lakh for 20 years) | 13017 Rupees | 13017 Rupees |

| Effective EMI after subsidy (for a loan of Rs 15 lakh for 20 years) | 10318 Rupees | 9899 Rupees |

Eligibility for Apun Ghar Home Loan Scheme

- Permanent Resident of the State of Assam

- Male and female

- Applicant’s minimum age should be 21

- The annual income of the person applying should be less than Rs 20 lakh

- The person’s bank account should be linked with the Aadhar card.

- Applicant can apply for loan up to 40 lakhs under the scheme.

- 05 years of residual service

- Those employees of the state whose service is less than 5 years in retirement will not be benefited.

- Employees who have already availed education and home loans from SBI at normal rates will also be able to switch to the government’s subsidized loan scheme after a year or so.

Documents required for Apun Ghar Home Loan Scheme

- Aadhar Card

- Permanent Certificate

- Caste certificate

- Age Certificate

- Bank Account

- Passport size photo

- Mobile Number

Benefits of Apun Ghar Home Loan Scheme

- The benefit of Apun Ghar Home Loan Scheme will be provided to the permanent residents of the state of Assam.

- This scheme not only provides benefits to the government employees but also to every resident of the state.

- Loan amount up to 40 lakhs is provided to the applicant taking advantage of the scheme.

- A subsidy amount up to ₹ 2.5 lakh will be given to the eligible beneficiaries through the scheme.

- Housing loan facility is provided at a concessional rate of 5% for female employees and 5.05% for male employees.

- Employees will be given a loan of up to 15 lakh on home loan for a period of 20 years.

- To take advantage of the scheme, applicants can take loan from Assam Gramin Bank, Scheduled Commercial Bank and Co-operative Bank.

- The loan amount given to the beneficiary will be directly transferred to their bank account.

Key Features of Assam Apun Ghar Home Loan Yojana

- Assam Apun Ghar Home Loan Yojana realizes the dream of making people a home.

- Through this scheme, people are given loans to build a pucca house.

- Loans are made available to the people through the scheme at low interest rates.

- Through this scheme the people of the state will be made self-reliant and empowered.

- Now people will not have to face financial crisis to get a house.

Assam Apun Ghar Home Loan Yojana Online Registration

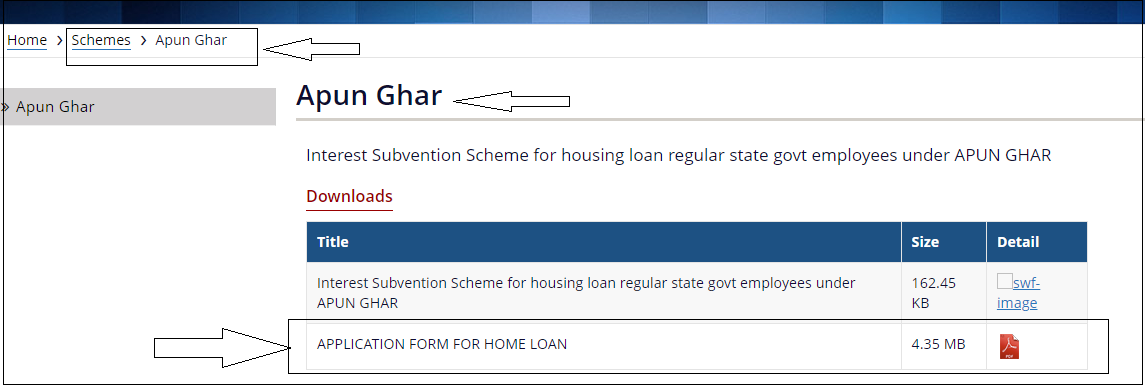

- To take advantage of the scheme, the beneficiary first has to go to the official website.

- After that you have to click on the scheme option and click on the link with Apun Ghar.

- As soon as you click on this link, the next page will open in front of you.

- Now you have to download the application form of the scheme.

- After that you have to take its print out.

- Now you have to enter all the information given in this form.

- Then you will also have to attach the necessary documents with the form.

- After all the process, you have to finally submit this form by going to Assam Gramin Bank, Scheduled Commercial Bank or Co-operative Bank.

- In this way you will be able to apply successfully under the scheme.

Apun Ghar Home Loan Scheme Helpline Number

To get more information regarding this scheme, applicants can visit the official website and get the helpline number.

I hope you have got all the information through this article. If you liked the article, please like and comment