Kerala MEDISEP Scheme : MEDISEP scheme has been implemented by the Government of Kerala for the welfare of the employees and pensioners of the state. Through which medical insurance is provided to the eligible beneficiaries to take care of their health. MEDISEP will cover all pre-existing diseases and will also provide cashless facility for listed procedures.

To take advantage of this scheme, the beneficiaries will be able to get treatment in the listed public and private hospitals of the state. How to get the benefit of this scheme and how to apply under it. To get all this information, you have to read this article till the end. So let’s know – about MEDISEP.

Kerala MEDISEP Scheme 2024

MEDISEP is a health insurance plan. This scheme has been started by the Government of Kerala to provide health facilities to the employees and pensioners of the state. MEDISEP scheme is applicable to those government employees and pensioners who receive grants-in-aid from state government and local self-government institutions. Through this scheme, eligible beneficiaries get cashless medical facility. Where holistic medical services can be availed by the applicant at a monthly premium of only Rs.500.

A total of 1920 treatments and surgical procedures are covered in the MEDISEP plan. However, the BBP package will include 1823 procedures. The financial expenses for a period of 15 days before and after hospitalization will also be covered through this plan. In addition, the scheme will also cover “unspecified procedures” up to Rs 1.5 lakh.

Overview Of the MEDISEP

| Name Of the Scheme | MEDISEP (Medical Insurance for State Employees and Pensioners) Scheme | |

| Started By | By the Government of Kerala | |

| Beneficiary | Citizens of the State | |

| Assistance to be Provided | Providing medical insurance cover | |

| Application Process |

|

|

| Official Website | medisep.kerala.gov.in |

Main aspects of the MEDISEP Scheme

- MEDISEP scheme has been started for the government employees and retired pensioners of Kerala state.

- During its three-year term, the program will provide assistance to 30 million people in the state.

- The scheme covers Rs 3 lakh annually.

- 1920 types of diseases covered under the scheme.

- Eligible people need to be hospitalized for at least 24 hours to get the benefits of this scheme.

- There will be total coverage of 15 days with financial assistance before and after hospitalization.

- Applicants can visit the official website www.medisep.kerala.gov.in for registration and all details.

- The last date to apply for MEDISEP has been fixed as December 31, 2022. Click Here MEDISEP Hospital List 2023 [District Wise]

Objective Of MEDISEP Scheme

The main objective of the scheme is to provide complete medical insurance cover to all pensioners, active employees of Kerala State Government as well as all pensioners of High Court.

Eligible Beneficiaries of MEDISEP Scheme

- All those employees of the State Government who are presently employed and who are working as per the 1960 Act.

- Apart from this, all the retirees who are getting pension.

- Beneficiaries in service staff who belong to the teaching and non-teaching sector of aided schools and colleges.

- Employees of universities aided by state government and local self-governing institutions

- Staff Member of Kerala High Court

- Among pensioners, teaching and non-teaching staff of aided schools and colleges and universities who are retired and who have received grants from the State Government and LSG.

- Direct Recruit Employees Pensioners and Family Pensioners

- Additional family members, children and spouses of teaching and non-teaching workers of aided schools and colleges

- If both the parents are in the beneficiary list of the scheme, then their children will also get the benefit of this scheme.

Ineligible Beneficiaries of MEDISEP Scheme

Employees and retired beneficiaries of independent organizations, cooperative institutions and boards like Kerala State Electricity Board (KSEB), Kerala State Road Transport Corporation (KSRTC), Kerala Water Authority (KWA) and retired beneficiaries will not be eligible for the scheme. Employees and retirees of State Information Commission and Human Rights Commission will also not be allowed to participate in the insurance scheme.

Important documents for this scheme

- Aadhar card

- Permanent Certificate

- Bank Account

- Passport size photo

- Mobile Number

Benefits of MEDISEP Scheme

- MEDISEP scheme provides cashless facility for the listed procedures.

- Coverage will be provided in case of accident or any other type of unforeseen medical emergency, which is included in the approved list of treatments and procedures.

- The scheme will cover the financial expenses of the given list for a period of 15 days before and after hospitalization.

- Under this scheme, if the mother of a newborn is insured under the MEDISP scheme, the newborns who are affected by any structural or functional disability till the end of the term of the plan are covered under this program.

- A total of 1920 treatments and surgical procedures have been covered in the MEDISEP scheme. However, the BBP package will include 1823 procedures.

- Through this scheme, hospital related costs such as accommodation, food, medicines, doctor and staff fees, and medical expenses will be paid for.

- Under Basic Package (BBP), this three-year program will benefit 3 crore people. It will give Rs 300,000 per year.

- Under the BBP, the general surgery therapy package, the category of “general surgery” has the largest number of treatment options (197). There are 168 packages in the Cardiology segment. There will be 156 packages in Surgical Oncology, 144 in Orthopedics, 147 in Dental Surgery and 111 in Plastic Surgery.

- The scheme will cover “unspecified procedures” up to Rs.1.5 lakh.

Contribution to the Plan (MEDISEP Scheme)

- The beneficiary is required to contribute Rs 500 per month from the salary of government employees and the gross entitlement of pensioners, which is Rs 6000 annually.

- Policy worth Rs.4,800 (inclusive of GST) will be provided by the government to the beneficiaries on an annual basis.

- If the insurance company finds that Rs 35 crore set aside for catastrophic illness is insufficient, it will use the additional funds received from the policyholder to meet the shortfall.

What happens if the employee is suspended?

In case an employee is currently on suspension, the premium for the time period will be deducted from his monthly allowance.

BBF Plan

- The basic benefit package to be covered under this system will include secondary and tertiary benefits.

- Treatments will also include care treatments, emergency and trauma care operations, as well as routine care.

- In addition, additional coverage will be provided for catastrophic diseases, such as organ transplant surgery. Additionally, it will provide coverage for any pre-existing conditions that the recipients may have. On the other hand, outpatient treatment will be excluded from coverage under the MEDISEP scheme.

- The basic benefit package will cover 1823 procedures.

Confirmed amount of BBP

- BBP provides annual coverage of Rs.3 lakh to the beneficiaries.

- Additionally, another mechanism, MEDICSEP, allows an increase in coverage to Rs.6 lakh.

- Basically, BBP has two components. One is stationary, having 1.5 lac, and the other is movable, called a floater system. It also includes 1.5 lakhs.

- Thus the floater system will be carried over to the next year if it is not used in the current year of the beneficiary, then total 4.5 lakhs will be added to the beneficiary in that year. Thus, in three years, if it is not used, it will pile up, and over the years it will go up to Rs 6 lakh.

- The cost of rooms is included in the basic benefit package and there are fixed rates, such as normal rooms costing up to Rs.1000, semi-private rooms costing up to Rs.1500. Any charges that are above these rates will not be covered by the insurance. ,

- Procedure cost – which includes the cost of major procedures and medications as well as the cost of pre-hospitalization medical advice and treatment, the cost of physician services, nursing expenses, post-discharge prescriptions, and hospitalization reviews, etc. Includes

- NPPA will decide how much the transplant will cost.

Expensive Procedures under BBP

- The plan covers most of its packages or procedures for the cardio segment and the most expensive treatments are also for cardiosurgery, ranging from Rs 1 lakh to Rs 2 lakh.

- Another costly surgery covered by BBP is aortic stenting, which involves an expense of up to 5.78 lakhs and if they exceed the rest, the patient has to pay for it himself.

- Intracranial Balloon Angioplasty with stenting is a popular operation with a maximum limit of Rs.2.03 lakh.

Catastrophic Package Costing

- There will be a single charge for each individual package.

- For example, the maximum amount that can be charged for liver transplant is Rs. 18 lakhs is Rs. Kidney transplant cost in India is Rs 03 lakhs. The cost of heart-lung transplant is Rs 20 lakh. The cost of cochlear implant is 6.39 lakh Indian rupees. The total cost of hip replacement is Rs.04 lakhs. Also the cost of implanting an auditory brainstem is Rs 18.24 lakh.

- The package will also include coverage for any relevant medical or surgical outcomes, and participating hospitals are instructed not to charge recipients for additional expenses resulting from these outcomes.

- A reserve fund with a minimum value of Rs 35 crore has been set up by the insurance industry exclusively for the treatment of critical illnesses.

Kerala MEDISEP Scheme Online Registration

- First of all the eligible beneficiary has to visit the official website.

- After that you have to click on Register option.

- Now the Registration Form will open in front of you.

- In this form you have to enter all the information.

- Then you have to upload the required documents.

- After filling all the information, you have to click on the submit button at the end.

- In this way you will be able to apply successfully under the scheme.

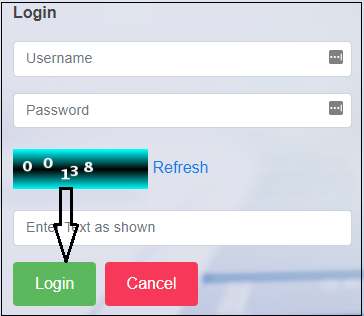

How to login

- First of all the eligible beneficiary has to visit the official website.

- Now you have to go to the login section.

- Here you will see many options. Like – University, Treasury, Municipality, Panchayat, Corporation, Department

- Now you have to click on one of these options.

- After that the Login Form will open in front of you.

- In this form you have to login by entering User Name / Password / Capcha Code.

- By following this process you will be login to the portal.

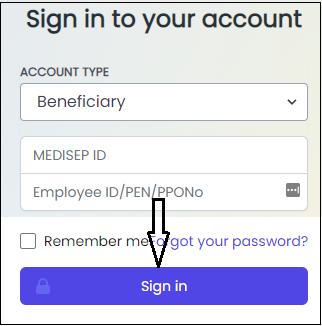

How to Download MEDCard

- First of all the eligible beneficiary has to visit the official website.

- Now you have to click on the option of “Download Medcard”.

- Now the login page will open in front of you.

- In which you have Account Type / MEDISEP ID / Employee ID / PEN / PPONo. etc. information has to be filled.

- Then you have to click on the Sign In option.

- After that Medcard will be displayed.

- Which you have to download.

I hope you have got all the information through this article. If you like the article then please like and comment.