Health Insurance Scheme | CM Health Insurance Scheme (CMHIS) | Online Registration || CM Health Insurance Scheme has been implemented to take care of the health of the citizens of Nagaland state. Through this scheme, equal, affordable and high quality health facilities will be provided to the citizens of the state. How to get the benefit of this scheme and how to apply under it. To get all this information, you have to read this article till the end. So let’s know about CM Health Insurance Scheme.

Nagaland CM Health Insurance Scheme

“Mukhyamantri Universal Health Insurance Scheme” has been launched for the welfare of the citizens of Nagaland state. This scheme will be implemented in conjunction with the Ayushman Bharat scheme of the central government. In the first group of the scheme, state government employees, pensioners, MLAs, ex-MLAs and employees of state PSUs and other organizations will be included. In this category, financial assistance of Rs 20 lakh will be provided to each family as an amount.

The plan aims to make an important step towards achieving Vision 2030. Let us tell you that by the year 2030, the people of the state of Nagaland will be provided with equal, affordable and high quality facilities and health care services to them. All indigenous and permanent residents of the state who are not participants of Ayushman Bharat or any other publicly funded insurance program will be provided benefits by being included in the CMHIS category of the programme.

Key Aspects of CM Health Insurance Scheme

Under the scheme, the sum insured for this category has been kept at par with Ayushman Bharat and has been fixed at Rs 5 lakh per family per year on floater basis. More than 1,950 medical and surgical care packages will be eligible to be availed under CMHIS. Applicants will be able to get their treatment done in any hospital in India participating in Ayushman Bharat program. On the other hand, the users of CMHIS (EP) will be eligible for the services which are provided by the health scheme of the Central Government to the workers of the Central Government. These patients will be able to get themselves treated at any of the participating hospitals in CGHS.

Overview Of the Health Insurance Scheme

| Name Of the Scheme | CM Health Insurance Scheme |

| By Whom Initiated done | By the Government of Nagaland |

| Beneficiary | Citizens of the State |

| Assistance to be Provided | Providing Health Care |

| Application Process | Online |

| Official Website | cmhis.nagaland.gov.in |

Objective Of the Nagaland Health Insurance Scheme

The main objective of the scheme is to provide health facilities to the citizens of the state, so that the eligible beneficiaries can get their treatment done in the best hospital.

Eligibility for CMHIS

- Applicant must be a permanent resident of Nagaland State.

- Families will be eligible to take advantage of the scheme on the basis of eligibility and income.

Important Documents

- Aadhar Card

- Permanent Certificate

- Bank Account

- Passport Size Photo

- Mobile Number

Benefits Of the CM Health Insurance Scheme

- This scheme will reduce the financial difficulties due to hospitalization expenses.

- The scheme is categorized into CMHIS Employees and Pensioners (EP), and CMHIS (General).

- CMHIS (General) category will comprise all indigenous and permanent residents of the state who are not beneficiaries of the Ayushman Bharat or any other public-funded insurance scheme. The sum insured for this category will be Rs 5 lakh per family per annum on a floater basis, similar to Ayushman Bharat

- The CMHIS (General) beneficiaries will be entitled to more than 1,950 medical and surgical packages. They can avail treatment from hospitals empanelled under Ayushman Bharat across India.

- the state government employees, pensioners, MLAs, ex-MLAs, and staff of state PSUs and other autonomous organizations, who are eligible for monthly medical allowance or reimbursement along with their dependent family members will be part of the first category. The sum disbursed for this category is Rs 20 lakh per family on a floater basis.

- For government employees, any additional expenses beyond the sum insured shall be reimbursed on a case-to-case basis on the recommendation of the State Medical Board.

- The Oriental Insurance Company Ltd is the insurance partner and the government will spend Rs 69 crore as premium for the first year of the scheme

- This is the first time that they are getting an opportunity to get empanelled and treat patients not only from the general population but also from among government servants who are as of now going for treatment outside the state

Features of CMHIS

- To take care of the health of the people of the state

- To bring health services to the people

- Beneficiaries will be able to get their treatment done in eligible hospitals under the scheme.

- Now even poor people will be able to get their treatment done in the best hospital.

- The beneficiaries will be made self-dependent and empowered through this scheme.

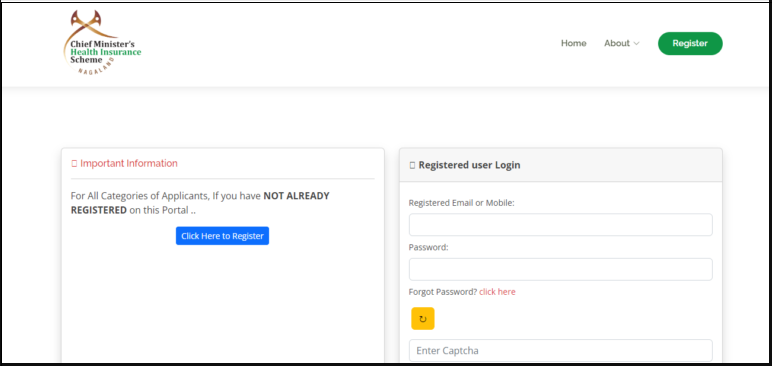

How to apply online for CM Health Insurance Scheme

- First of all the eligible beneficiary has to visit the official website.

- Now you have to click on Register button.

- Now a new page will appear in front of you

- In this you have to enter login details like register email id or mobile number and then password.

- Then you have to click on the login button.

- Now you have to fill the form. (Registration of families under the general population).

- After that you have to take a print out of the filled form.

- Then you have to sign the printer paper form.

- The signed paper is to be scanned, then it has to be uploaded along with any other necessary supporting documents.

- After all the process is done, you have to click on the submit button at the end.

- In this way you will be able to apply successfully under the scheme.

Hope you have got all the information through this article. If you like the article then please like and comment.