WB Student Credit Card Yojana : Student Credit Card Yojana has been implemented by the Chief Minister of West Bengal to uplift and empower the students in the state. Under which a loan of Rs 10 lakh will be given to the students to provide higher education. How to get the benefit of the scheme, who will be eligible for the scheme and how will the application be made under the scheme. To get all this information, you have to read this article till the end. So let’s know about West Bengal Student Credit Card Yojana.

West Bengal Student Credit Card Yojana 2024

Student Credit Card Yojana has been started by the Government of West Bengal to protect the future of the students. Under which the students of the state who want to pursue higher studies will be given a loan of up to Rs 10 lakh. The special feature of the scheme is that the student will be given 15 years to repay the loan after getting the job.

All eligible students will get Student Credit Card with credit limit at an interest rate of 4%. This scheme will benefit more than 1.5 crore students in the next 5 years. From June 30, the student credit card scheme will be started in the state. Beneficiaries will be able to get the benefits of the scheme by online registration.

Overview of Student Credit Card Yojana

Yojana | West Bengal Student Credit Card |

| Applicable Year | 2024 |

| State | West Bengal |

| Launch by | CM Mamata Banerjee |

| Eligible beneficiary | students who want to pursue higher studies |

| Counting of Beneficiaries | 1.5 crore |

| Type of the Scheme | Soft Loan Through Student Credit Card |

| loan amount | 10 Lakh |

| Rate of interest | 4% |

| Age Range | 40 Year |

| Repayment time | 15 years after getting the job |

| Application Process | Online |

| official website | https://wbscc.wb.gov.in/ |

Objective of the WB Student Credit Card Yojana

The main objective of the scheme is to provide a loan of Rs 10 lakh by the state government to the students pursuing higher studies at an interest rate of 4%.

Implementation of the Student Credit Card Scheme

Keeping in mind the interests of the citizens in the state, many schemes have been run by the Mamta government. Out of which the promise of starting the credit card scheme being run for the students of the state was made in the assembly elections. For the implementation of the scheme, the eligible students of the entire state will be included in the West Bengal Student Credit Card Scheme by the government. Due to which more than 1.5 crore students will be benefited in the state.

Online Registration for the Student Credit Card Scheme

Student Credit Card Yojana is being run for the students of the state who want to continue their studies after 10th or 12th class. Credit cards will be made available to the students under the scheme. Beneficiaries will be able to avail this facility through online mode. Students whose credit card will be used, they will get a loan of Rs 10 lakh through the scheme. With the help of which the students will not have to face financial crisis during their studies.

Eligibility for WB Student Credit Card Yojana

- Permanent Resident of the State of West Bengal

- Applicant should have spent 10 years in the state

- Students pursuing undergraduate, postgraduate, doctoral and post-doctoral studies in India or abroad will be eligible for the loan.

- A person is eligible for the scheme till the age of 40

- A student will get 15 years to repay the loan after getting a job.

Documents Required For this Scheme

- Identity Proof (Aadhar Card/ Pan Card/ Passport Copy)

- Permanent Certificate

- Educational Qualification Document (10th. and 12 class Marksheet)

- Bank Account details

- Passport size photo

- Last six month bank account statement

- Mobile Number

Benefits of the Student Credit Card Scheme

- The permanent residents of West Bengal state will get the benefit of Student Credit Card Scheme.

- Loan up to Rs.10 lakh will be given to the students continuing their studies after class 10th or 12th through the scheme.

- The eligible beneficiary will be given 15 years to repay the loan.

- Loans to students under the scheme will get an interest rate of 4%.

- Students and girls pursuing undergraduate, postgraduate, doctoral and post-doctoral studies in India or abroad can take this loan.

- The loan amount will be transferred to the bank account of the eligible beneficiaries.

- Credit cards will be issued only to the beneficiaries who will apply under the scheme. The loan will be given to the beneficiaries only through the card issued.

Features of the WB Student Credit Card Yojana

- shaping the future of students

- To provide financial assistance to the students by the state government during their studies.

- To make eligible beneficiaries self-dependent and empowered

- Strengthening the economic side

- Now students will not have to leave their studies incomplete due to financial constraints.

West Bengal Student Credit Card Yojana Online Registration

- First of all the beneficiary has to visit the official website.

- Now you have to click on the option “Student Registration”.

- After that the application form will open in front of you.

- You have to fill all the given information in this form.

- After that you have to click on “Register” button.

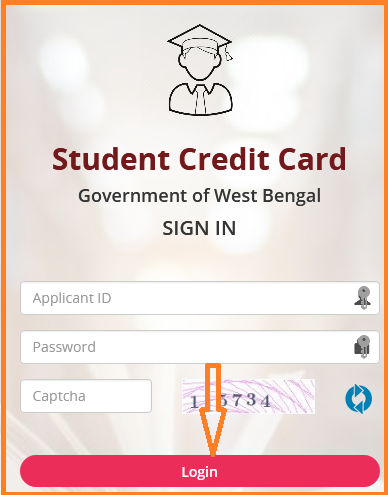

Student Credit Card Yojana – Login Process

- First of all the beneficiary has to visit the official website.

- Now you have to click on the option “Student Login”.

- Now the login form will open in front of you.

- In this form you have to fill all the given information.

- After this process, you have to click on the “Login” button.

- In this way the login process will be completed by you.

WB Student Credit Card Scheme – Dashboard Process

- First of all the beneficiary has to visit the official website.

- Now you have to click on the option “Student Login”.

- Now the login form will open in front of you.

- In this form you have to fill all the given information.

- After this process, you have to click on the “Login”

- After that you have to click on Dashboard

- You can view the student dashboard by following this procedure

Student Credit Card Yojana Application Status

- First of all the beneficiary has to visit the official website.

- Now you have to click on the option “Student Login”.

- Now the login form will open in front of you.

- In this form you have to fill all the given information.

- After this process, you have to click on the “Login”

- Now you have to click on track application

- After that you have to enter your applicant ID

- Now you have to click on search Button

- After that the required information will come on your computer screen.

How to Download Training Manual

- First of all the beneficiary has to visit the official website.

- Now the home page will open in front of you

- Here you have to click on User Manual

- After that you have to click on Training Manual

- After this process the training manual will appear in front of you in PDF format

- You have to click on the download option to download it.

User Manual Of Institutions

- First of all the beneficiary has to visit the official website.

- Now you have to click on the download option.

- Then you have to click on the option “User manual Of Instruction”.

- Now PDF file will be open in front of you. which you have to download.

Procedure To Download User Manual Of HED

- First of all the beneficiary has to visit the official website.

- Now you have to click on the download option.

- Then you have to click on the option “User manual Of HED“.

- Now PDF file will be open in front of you. which you have to download.

Download User Manual Of Bank

- First of all the beneficiary has to visit the official website.

- Now you have to click on the download option.

- Then you have to click on the option “User manual Of Bank“.

- Now PDF file will be open in front of you. which you have to download.

How to Online Application And Loan Sanction Process

- First of all the beneficiary has to visit the official website.

- Now you have to click on the administrator login.

- After that you have to choose your user type.

- After this you have to enter your User ID, Password and Captcha Code and click on Login.

- Now a dashboard will appear in front of you.

- Here you have to click on “Application Pending” option.

- After that a new page will open in front of you

- On this new page “MS Excel Sheet” containing all pending applications will be generated.

- Now you have to click on “Download Excel Button” to download.

- You need to click on “view icon” to view this application

- Now another new page will open in front of you

- From this page you have to download the following documents :-

- PAN and Aadhaar

- PAN address proof of co-borrower

- Course Fee Details

- Proof of Admission etc.

- After this process you have to click on “Application Pending Menu” of the Dashboard.

- After that you have to click on the sanction loan icon of a particular application.

- From here you can either approve the loan or decline the loan by applying on the loan reject button.

WB Student Credit Card Yojana loan approval process

• If the loan is approved, a new page will appear in front of you

• In this page you have to enter the acceptance amount in numbers and words

• Now you have to upload the copy of the acceptance letter.

• After that you have to click on submit button.

If the loan is declined

• If your loan gets rejected then you have to click on Reject Loan option.

• After that you have to select the rejection reason from the drop down menu.

• Then give the benchmark for the standards in words as per your bank norms.

• After this process you have to click on submit.

Procedure To Do Institution Profile Submission

- First of all the beneficiary has to visit the official website.

- Now you have to click on the administrator login.

- Now you have to choose your user type

- After that you have to login after entering user id, password and captcha code.

- Now a new page will open in front of you

- In this page you have to click on “Submit Institution Details”

- Now you have to enter the following details:

- Name of the Institution, AISHE Code, Aggregation Details, Rank Type, Post, Affiliation Details, Address of the Institution, Status of the Institution, District of the Institution, Name of the Nodal Officer, Designation of the Nodal Officer, Email ID of the Nodal Officer, PAN of the Institution , Institute Body Number, IFSC Code, Institution Bank Name, Branch Name, Account Number, After that you have to upload the following documents, AISHE Certificate, Accreditation Document, Rank Document, Affiliation Document.

- After this process you have to click on submit details.

- Now submit your institute profile.

Approve The Application by HED

- First of all the beneficiary has to visit the official website.

- Now you have to click on the administrator login.

- Now you have to choose your user type

- After that you have to login after entering user id, password and captcha code.

- Now you have to click on Verify application.

- Then you have to click on view application.

- Now you will see a dialog box with forward, return, view and track buttons with photograph and application

- You have to click on the View button to check all the details of the applicant

- If all the details are found correct then you have to click on the further option.

- Now a confirmation page will appear in front of you

- Here you have to click on Yes option.

- Now this application will be forwarded to the bank

- Now you have to change the status so that the user can see the status of the application forwarded to the bank

- If the application is found correct then you have to send it to the head of the institution by clicking on the return button.

wbscc.wb.gov.in Contact Details

- First of all the beneficiary has to visit the official website.

- Now you have to click on the option of contact us.

- By clicking on this button, the related information will come on your computer screen.

Bina Mulya Samajik Suraksha Yojana

I hope you have got all the information through this article. If you like the article then please like and comment.